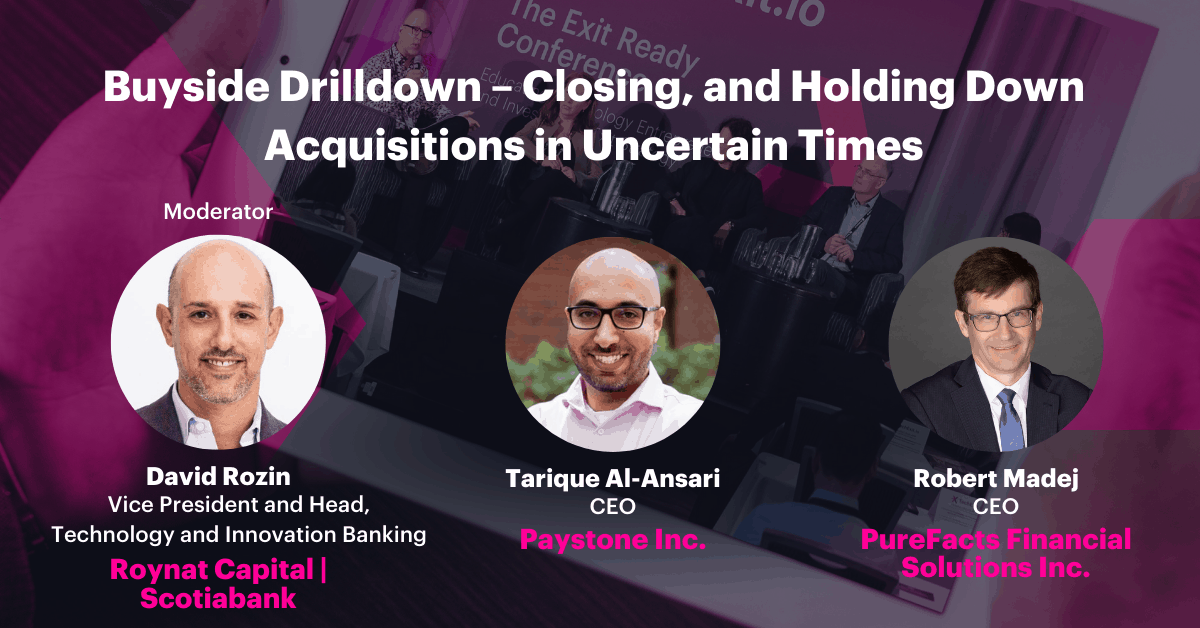

Buyside Drilldown – Closing and holding down acquisitions in uncertain times

TechExit

A look at what our expert panel will explore at TechExit East and TechExit West

The unexpected global outbreak of COVID disrupted and transformed all aspects of our daily lives from how we work to how we build relationships and communicate with our families, teammates, customers and business partners.

It took time to adjust to the new normal, and during that adjustment period, many business activities were put on pause as business leaders re-assessed the impact of the global economic shutdown. M&A activity slowed to a halt at the onset of the pandemic as valuations became distorted, due diligence more challenging, and integration post-transaction highly complex. Despite the odds, two leading Canadian fintech founders charged boldly forward, working closely with their key partners and advisors to navigate this new terrain and successfully close strategic acquisitions.

Join David, Tarique, and Robert at the session Buyside Drilldown – Closing and holding down acquisitions in uncertain times as they discuss what compelled these two CEOs to continue pursuing these transactions, how they overcame valuation and due diligence hurdles, a changing capital landscape, and what they learned from their experiences.

“Due diligence looks very different as a result of the COVID restrictions,” says Tarique Al-Ansari, CEO of Paystone. “You can’t walk into an office, meet the people and get a feel for the company culture, which is a normal part of the due diligence process.” He shares that one of the ways he was able to learn more about the acquired company was through reading customer reviews online and by having his team connect and share feedback with their counterparts at the acquired company.

“Above all, make sure you communicate clearly, and that everyone including your advisors are aware and informed of what is happening and how the plan is progressing,” he adds.

Robert Madej, CEO of PureFacts, agrees that due diligence is very different compared to pre-COVID times. His company recently acquired a company based in the Boston area, which added an additional layer of complexity due to the Canadian/American border closure. While cross-selling into the US market hasn’t happened as quickly as Robert had hoped, the integration of the company is going very well.

“Despite the unique challenges presented by COVID, we’ve been pretty successful,” says Robert. “We have an integration plan developed by Stratford Managers in Ottawa, and our internal team is leading the implementation of the plan. Our company president meets weekly with the president of the company we acquired, which is also very helpful.” He adds that having similar values and culture has also contributed to the success in the integration.

One of the greatest challenges for companies doing deals during the pandemic is learning how to build trust and rapport in a virtual world. “Collaboration is essential to get the deal across the finish line. In the virtual world, how do you build trust and rapport when you have never met each other face to face?” says Robert. “To be successful, you have to be comfortable doing things different and building relationships on video calls. Trust will drive behaviour and create good synergies that will help you close the deal.”

Access to capital is another critical factor that impacts many aspects of the transaction from purchase price to deal structure. When it comes to debt, selecting the right provider comes down to more than price. Consideration should be given to breadth of product capability, execution expertise, industry expertise, creativity, and flexibility. As a capital provider whose core mission is to support Canadian tech founders achieve their ambitions and drive enterprise value growth, Roynat Capital’s Technology & Innovation Banking group acts as a long-term partner in a company’s journey. David’s team is the only technology specialized lending group in Canada with product capabilities spanning senior, subordinated and mezzanine financing structures. More importantly, the team has a deep understanding for what it takes to grow tech companies with experience spanning venture capital, private equity, and lived operational experience gained supporting some of Canada’s fastest growing technology companies.

“Our strength is our creativity and the depth of dialogue we can have with founders. Everything we do is through the lens of a Technology founder. We understand the ultimate goal and can chart a path to reach it. If we can help founders gain additional flexibility, speed or limit potential dilution, we’ve added tremendous value” says David. “The pandemic and its economic impact placed an additional layer of complexity towards considering and executing these types of transactions; we can help.”

As a national practice, Scotiabank/Roynat Capital is a proud sponsor of both TechExit East and TechExit West.

Join David Rozin VP & Head of Technology & Innovation Banking at Roynat Capital, Tarique Al-Ansari CEO of Paystone Inc., and Robert Madej CEO of PureFacts Financial Solutions Inc. as they discuss how Paystone and PureFacts defied the odds and successfully closed their acquisitions during COVID-19. This session, Buyside Drilldown – Closing and holding down acquisitions in uncertain times will be featured at both TechExit East and TechExit West and is a must-attend session for anyone considering growth through M&A. Purchase your pass for TechExit East here and TechExit West here.

BACK