Why This Founder Turned Down 3 Acquisition Offers and Asked Lightspeed to Buy His Startup Instead

Stefan Palios

We’re lucky in Canada today that the phrase “IPO” is increasingly common. When JD St. Martin took on venture funding for his Montreal-based startup Chronogolf in 2014, selling the company was considered an inevitable outcome. Still, he managed to make the best of it, selling to Lightspeed and joining the team, where he still works today as Chief Revenue and Chief Customer Officer. Speaking with TechExit.io, JD explained why he turned down three other acquisition offers then asked Lightspeed to acquire his startup instead.

Key takeaways:

- When trying to sell your company, know what end you want: more growth or simply an exit.

- Regardless of desired outcome, make sure you consider your employees and customers in all acquisition decisions.

- Post-acquisition, look for opportunities to grow as a leader within the new company, even if that means letting your baby go.

Check out the full interview below. Enjoy!

After selling his startup Chronogolf to Lightspeed, JD St. Martin suddenly awoke in a new reality. No longer the leader of his own company, he had become a managing director of a division within a much larger corporate machine. This kind of experience is one few founders go through - and even fewer enjoyed it enough to look back fondly. Luckily, JD had a great experience. Speaking with TechExit.io, JD reflected back on the story of how he turned down three other offers before selling to Lightspeed and what life has evolved to now that he’s officially on team Lightspeed.

Wine, golf, and SaaS

Over wine with a semi-pro golfer, JD and his business partner got to talking about golf problems. The trio, all being avid golfers, lamented how frustrating it must be to run a golf course: you have to deal with course memberships, restaurants, quick service food, sometimes a bar, and occasionally even a hotel to manage all in one mini-empire.

“The industry was archaic from a tech perspective,” said JD. “Club owners had to deal with so much manually. It was an interesting industry to disrupt.”

Being entrepreneurs on top of just golfers, this sparked an idea: a SaaS product that could help golf club owners manage their entire business on one platform. No more manually reconciling club revenue with restaurant expenses or other issues like that.

This spark led to Chronogolf, which came to market in 2013.

In 2014, after some initial traction, JD and his co-founder Guillaume Jacquet realized many golf club owners wanted a point of sale (POS) system integrated into the Chronogolf platform. Not wanting to build one themselves, the duo decided to use Lightspeed POS, another Montreal company making waves in the tech space at the time.

“We went through the classic startup journey: building a product, raising capital, and finding product-market fit,” said JD.

Time to exit, but not IPO

After five years of growth and going from a simple idea to a thriving 60+ person venture-backed startup, JD got a completely unexpected inbound acquisition request. Naturally, he brought it up to the board, and they started to debate taking the offer. As JD puts it, acquisition was seen as an inevitable end, so the offer was worth considering.

“Naturally, when you raise capital, it’s always in the back of your mind that at some point there will be a liquidity event,” said JD. “At the time, you didn’t see a lot of tech IPOs, so that meant getting acquired.”

After poring over the offer, the board realized it had two choices: raise a massive growth round of financing to build out or sell and grow within the walls of a different company.

“At this point in our journey, we would have needed to either raise a massive round, which meant a lot of dilution, or look for an exit,” said JD.

The leaders decided an exit was the right move. However, they also felt the first inbound offer would not give them the growth they wanted post-acquisition, so they turned it down. After turning down the first offer, JD made it known privately to investors and his network that the company was open to acquisition offers.

Dancing with buyers but marrying someone else

A few months after JD made it known the company was open to acquisition, four more interested parties came to the table resulting in two solid offers. But something was wrong - and it wasn’t the valuation or terms.

“Both offers were fair, solid offers, but something occurred to me: the growth story we wanted - which is to grow within the walls of another company post-acquisition - may not happen in these companies,” said JD.

Specifically, JD wanted to continue focusing on golf, continue building out more products for golf clubs and the golf market, and add more value to the golf ecosystem as a whole. He didn’t want to simply be acquired and lock himself into a cushy job or nice payout. Acquisition was a growth tool that helped him avoid needing to go it alone, and he wanted an acquirer who saw it that way, too.

Accelerating into Lightspeed

That’s when a lightbulb went off in his head: Lightspeed. To him, Ligthspeed would be the perfect acquirer because it would take care of employees, customers. and growth - the three things JD wanted in a buyer.

Employees: After years of partnering with the company, almost all Chronogolf employees had engaged with Lightspeed employees at one time or another. That gave JD confidence that the teams could continue to work together and a Lightspeed acquisition would not be jarring for employees.

Customers: The platform was already built with Lightspeed in mind, so JD figured further integrations would not be that difficult and would focus on driving more value for Chronogolf’s existing customers.

Growth: The company was known for growing through acquisition, but had an internal team to aid with integrations, team transitions, and identify growth opportunities for both companies through the acquisition.

With a renewed sense of direction, JD turned down the two acquisition offers. He then approached Lightspeed’s leadership team and asked them to buy his company, highlighting the amazing mutual opportunity they had in front of them.

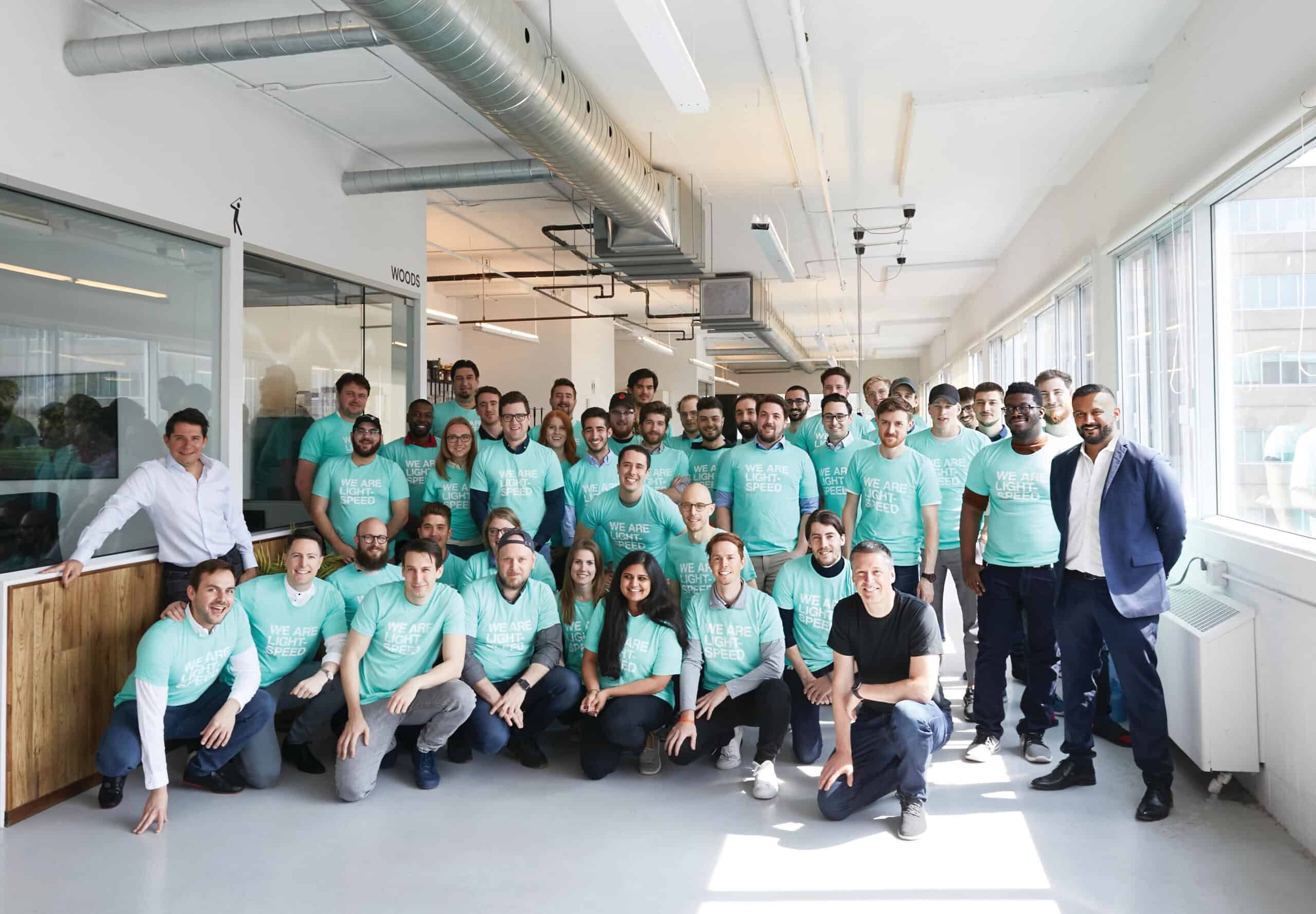

Lightspeed said yes, and the acquisition was completed in May 2019, rebranding Chronogolf to Lightspeed Golf.

“It wasn’t just about the money, but the ethos of the business,” said JD. “Lightspeed is a great company to grow within.”

Waking up in the afterlife

The first six months of JD’s new life were focused on integrations, and he didn’t regret the acquisition for a second. But after all the systems were integrated and Chronogolf’s team was comfortably operating under the Lightspeed Golf banner, it was time for JD to let go and move onto a different role within the company.

“I took over Account Management and our customer success team globally,” said JD. “I had to let the baby go.”

JD’s role within Lightspeed has evolved a couple more times since then, and he is now the Chief Revenue and Chief Customer Officer of the company. He’s responsible for integrating the entire customer journey in collaboration with Lightspeed’s matrixed functional, regional, and industry leaders.

It’s been like “drinking from a fire hose,” but looking back on the acquisition he’s grateful he made the choices he did.

“It’s been an amazing journey on the personal side,” said JD. “And it’s equally rewarding to see the Lightspeed Golf team continue to grow and crush it.”

BACK