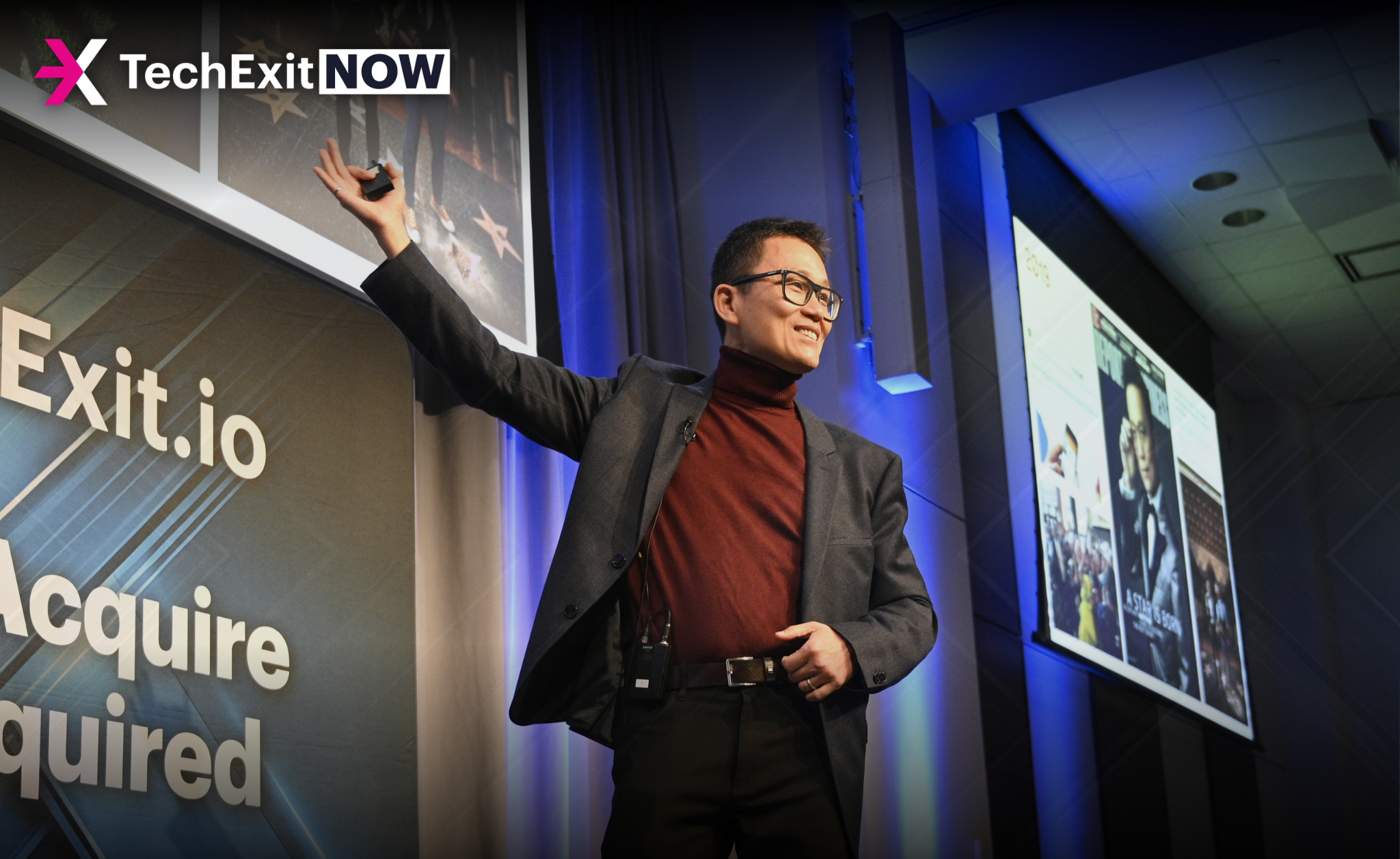

In technology, mergers and acquisitions are a regular occurrence and can be a path to growth. Every tech company needs to be “M&A Ready”. Learn from the biggest acquisition success stories and connect with the players that made them happen at TechExit.io!

Taking place on February 19, 2026, in Vancouver, October 1, 2026, in Calgary, and October 15, 2026, in Toronto, TechExit.io caters to both eastern and western Canadian markets. With two strategic locations, our events are designed to serve the unique needs of tech companies across Canada, offering tailored insights into regional market dynamics and acquisition strategies.