The 3 Questions FreshBooks Uses to Assess Potential Acquisitions

Jessica Galang

Key takeaways:

- Before you look at possible acquisitions, set up a framework of what acquisitions are meant to do for your company’s mission and vision.

- Focus on business value, mission, and values alignment before getting into the nitty gritty financials of a deal.

- Realize that acquisitions are simply one growth option, but it’s not required to be successful.

FreshBooks just acquired FastBill, but it was kind of like any other day for CEO Don Epperson. As the company focuses on growing into its mission to build the best software for small businesses and their teams, acquisitions are just one way to grow. Speaking with TechExit.io, Don shared why acquisitions matter to FreshBooks and the three questions he uses to assess whether a potential acquisition makes sense.

Why acquisitions matter to FreshBooks

“It’s very difficult to scale a global organization from a particular country or a particular city,” said Don. “For example, what do we know, from Toronto, about what’s happening in the Indian, Mexican, or German markets?”

This perspective - that a global company must truly be global - has helped inform FreshBooks’ acquisition strategy, particularly when it comes to three things:

- Languages: FreshBooks historically only operated in English.

- Relationships: Local accountants and government organizations might be weary of a foreign company coming in without local context.

- Technology: Both providing net-new features to the platform and delivering context or region-specific features that FreshBooks needs on its global mission.

Acquisitions are not the only way to achieve these three goals and Don thinks about multiple dimensions of scale when it comes to FreshBooks. But acquisitions help accelerate these goals, particularly when a new priority comes up against an already-full roadmap.

“You can do a lot organically, but if you want to get into more countries quickly with a different language, compliance system, or local customs, then you can start looking at acquisitions,” said Don.

How FreshBooks assesses acquisitions

Buying a company is not a given, even if it solves a problem for FreshBooks. Instead, Don and the FreshBooks leadership team asks three key questions before diving into the financials and other business details.

Question 1: Will this help us get closer to the customer?

FreshBooks never wants to build from an ivory tower, so remaining close to the customer’s challenges and context is necessary.

Don shared the story of two acquisitions - Facturama in Mexico and FastBill in Germany - to illustrate this point.

In Mexico, governments want to ensure they collect all taxes they are owed. To enable this, the government introduced a digital stamp for invoices to ensure taxes are paid on it. As a way of encouraging compliance, no business expense in Mexico can be deducted from your taxes without the invoice having a stamp.

This is a niche feature that’s critical in Mexico, but not common elsewhere in the world. While the FreshBooks team could have built this feature from scratch, acquiring Facturama gave them a ready-made feature and helped them build local government relationships to keep the business sustainable.

In Germany, language and local relationships were key challenges. Don said FreshBooks had no immediate plans to organically expand into German-speaking markets and that the accounting system was much more integrated with local tax authorities than in other countries. Instead of starting a years-long quest to build relationships and hire German-speaking teams, acquiring FastBill helped them bridge this gap almost immediately.

Question 2: Do you have the same passion for our mission?

Language, relationships, or technology fit is critical, but not enough to justify an acquisition. The second question Don deeply cares about is whether the company’s mission aligns with FreshBooks’ mission.

“You have to be 100% focused on small business entrepreneurs, or “owners” as we call them,” said Don. “Building a small business can be a lonely experience, and we want any company we might acquire to have empathy for the owner.”

Question 3: Do we have a foundationally similar culture?

With a great platform and mission alignment in check, the final question is whether the two companies have a foundationally similar culture. All acquired companies are merged into the FreshBooks brand with support from the FreshBooks acquisitions team, so there has to be some common ground to start. Technical timelines are custom because FreshBooks plans each integration to ensure that no customer loses features they loved from the old platforms, but the teams start to collaborate almost immediately.

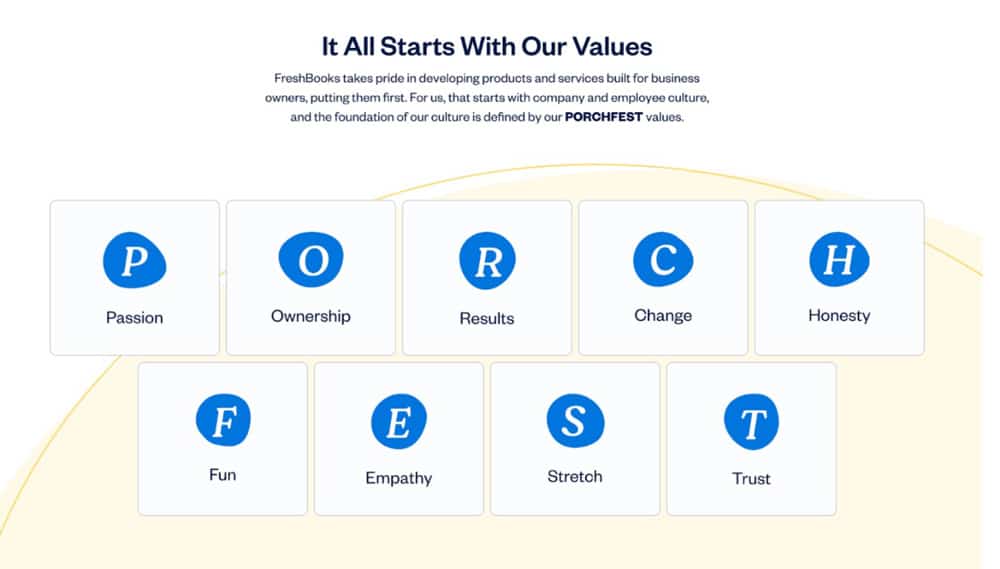

“You don’t have to be identical to us, but how you operate as a team has to be grounded in the same foundational values we have at FreshBooks,” said Don.

Good, fast, cheap: pick two

As a leader, Don believes wholeheartedly in the adage that you can only choose two between something that is good, fast, and cheap. In his view, acquisitions are about being fast and good, acknowledging it might be cheaper to build something in-house but you lose out on growth opportunities if you remove the acquisition tool from your tool shed.

“We have this vision and mission in servicing business owners all over the world,” said Don. “We’ll build organically as much as possible, but we will use this inorganic tool in our toolshed to enable us to build the vision even faster.”

BACK