OCTOBER 15, 2026 • MaRS CENTRE • TORONTO

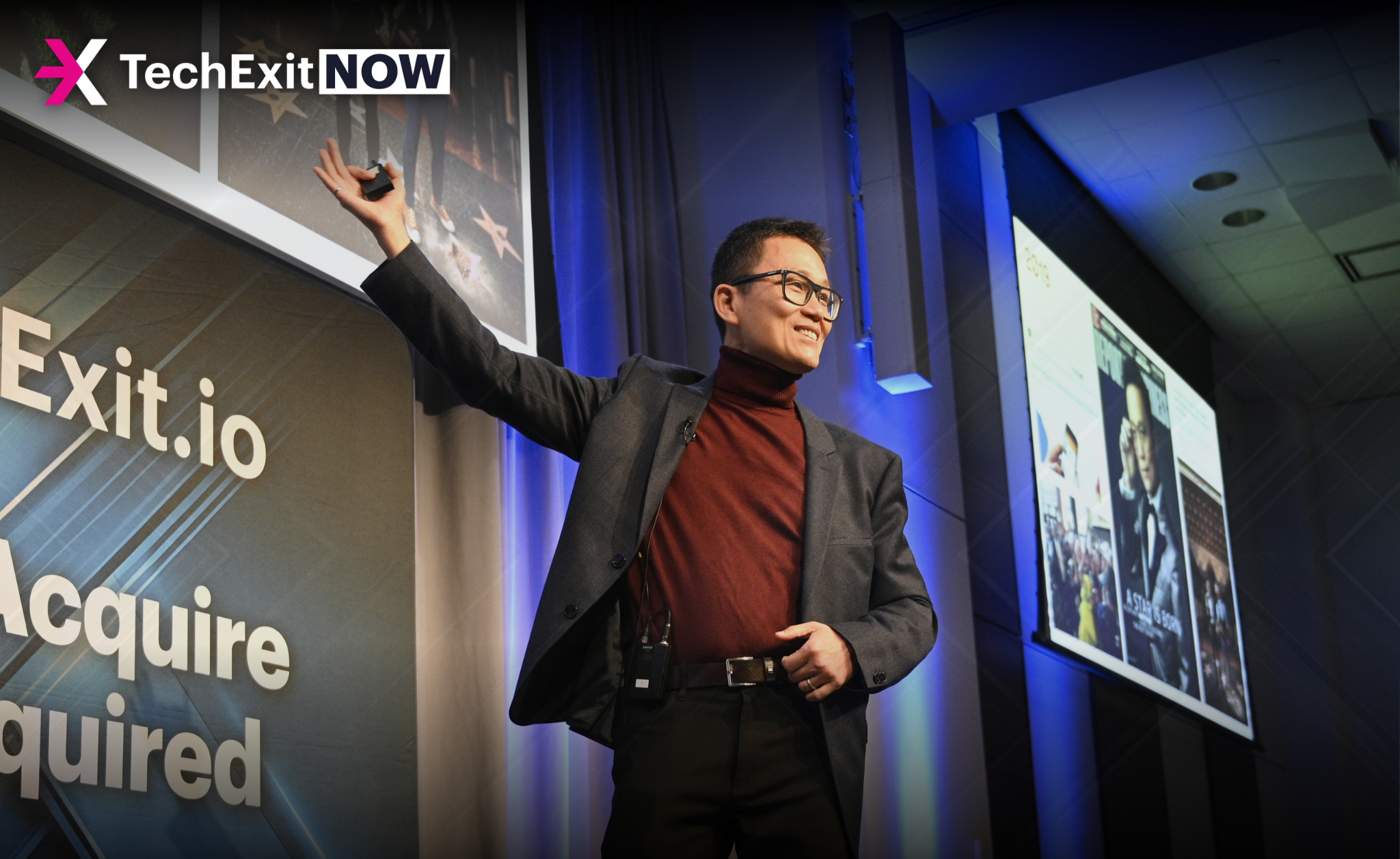

Mastering The Art Of Tech Acquisitions & Exits

TechExit.io is the go-to event for technology industry players who want to understand the ins and outs of selling and buying technology companies.

OCTOBER 15, 2026 • MaRS CENTRE • TORONTO

TechExit.io is the go-to event for technology industry players who want to understand the ins and outs of selling and buying technology companies.

TechExit.io is where startup & scale-up founders, and corporate innovators come to master the strategies, signals, and secrets behind buying and selling tech companies. Whether you’re planning your first exit, eyeing your next acquisition, or building with buyout in mind—this is the roadmap to scale smart and exit strong.

In today’s fast-paced tech landscape, every founder should start with the end in mind.

At TechExit.io, we decode how to:

*When You Bring 2+ Tech Executives

Plus learn from the biggest exit success stories, the multiple exit stories, and connect with the players that made them happen.