Program

I hope you enjoy it!"

–Michael

May 8, 2024

This session offers a detailed overview of the present economic conditions and their impact on tech M&A. From market dynamics to emerging opportunities. The discussion will cover industry sector differences and market trends that entrepreneurs need to consider to understand how they impact their businesses. The session will also uncover strategic opportunities available in the current M&A environment.

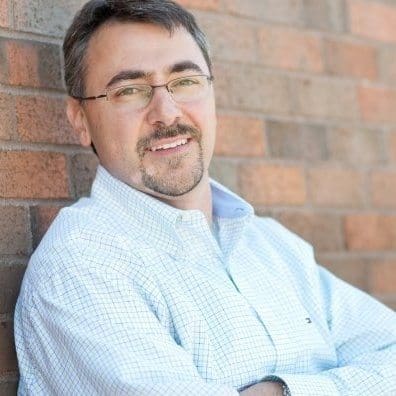

In this discussion, we will explore the incredible journey of Surrey, BC-based Safe Software. Recently, the company has been making headlines due to a strategic investment from JMI Equity, a well-known American growth-stage investor known for backing prominent Canadian tech firms. Don Murray, the company’s Co-founder and CEO, will provide insights into the intricacies of this milestone deal and what it means for Safe Software. He will also share the secrets behind the company’s incredible growth, from a project focused on sharing geospatial forestry data to becoming a global leader in data integration solutions, with over 25,000 customers across 121 countries. As the company looks to the future, you will hear first-hand how this investment marks a new chapter for Safe Software.

Don Murray, Co-founder & CEO, Safe Software ($200-million-plus investment from JMI Equity)

This panel of experienced lawyers, investment bankers, and serial acquirers will discuss why M&A deals falter and how to avoid common pitfalls. They will share their knowledge on identifying deal-breakers, overcoming obstacles during due diligence, implementing strategies to mitigate risks, and mastering negotiation tactics to secure favourable terms.

Matt Diederichs, Head of Strategy & Corporate Development, Invoca (Formerly Corp Dev at Hootsuite)

Gordon MacNeill, Principal, Accel-KKR

Geoff Pedlow, Partner, Fasken

In today’s funding landscape, it has become increasingly challenging for tech startups to secure traditional sources of capital to fuel their growth. As a result, many entrepreneurs are exploring alternative financing options such as VC investing, revenue-based financing, and crowdfunding. This panel of VCs and alternative lenders will provide insights into the pros and cons of alternative financing options. If you’re an entrepreneur looking for funding, attend this session to learn how to navigate the funding landscape and discover the best alternative financing option for your startup.

Devon Thompson, Managing Director, RBCx

Bruce Townson, Director, Growth & Transition Capital – Tech Sector, BDC

Monique Morden, President, TIMIA Capital

Are you considering selling your business but feeling overwhelmed by the process? Look no further! This session is designed to provide you with all the information you need to know about selling a company. You’ll discover the optimal time to sell and gain insights into the often overlooked aspects of M&A. The session will explore untapped options and reveal the key drivers of value in a sale, even for companies that aren’t yet profitable. You’ll also learn about capital strategy and the best approaches to raising capital in preparation for M&A. Finally, we’ll give you an insider’s perspective on the questions buyers and sellers commonly ask. This session will bridge the gap between sellers and buyers and help you optimize your path to a successful exit.

Aaron Gould, Co-Founder & CEO, OneComply Inc. (acquired by GeoComply Inc.)

Andrew Hennigar, Partner, Borden Ladner Gervais LLP

Alex Lane, Director, Investment Banking, Stifel Canada

This compelling case study delves into the inspiring journey of Nazim Ahmed, a true entrepreneur who has experienced all the highs and lows of launching a startup. From facing job loss and financial turmoil to spearheading Canvaspop, a side hustle that flourished into a lucrative business acquired by Circle Graphics for an impressive $30M, Nazim’s narrative is a shining example of the resilience and determination necessary for startup success. In this session, you will gain insights into the strategic partnerships and decisions necessary for growth and the unwavering dedication needed to navigate the unpredictable landscape of entrepreneurship. Nazim’s journey will empower you to tackle your own startup challenges and pave the way for a successful exit.

Nazim Ahmed, Co-Founder & CEO, remx.xyz (Co-Founder of Canvaspop - Acquired by Circle Graphics for $30M)

Kevin Sandhu, CEO & Co-Founder, Otter (Founder of Grow Technologies- Acquired by ATB Financial)

Get ready for an insightful discussion on the current landscape of tech valuations. Our panel of seasoned industry experts will take a dive deep into the latest valuation trends, providing you with sector-specific insights and real-world examples of transactions. Our speakers will also address your pressing questions, revealing the secrets to achieving higher valuation multiples, navigating market fluctuations, and unlocking post-investment strategies for improved valuation.

Diraj Goel, Founder & CEO, GetFresh Ventures

Jaime McNally, Director, Ventures, FrontFundr

Sophie Ngo, Senior Associate, TELUS Ventures

David Rozin, Vice President & Head, Technology and Innovation Banking, Scotiabank/Roynat

Entrepreneurs create better mousetraps – products and services that outperform. But even if they’re wildly successful, these entrepreneurs are stuck in a cycle of optimization, customization, and (gulp) price cutting. It’s relentless, exhausting, and limiting.

Big brands know something many entrepreneurs don’t: the path to massive mainstream audiences isn’t building better products. It’s building brands.

Investors love sustainable, scalable, de-risked growth. That’s why they love entrepreneurs with solid brands.

You can build a brand investor love while you build your product and set yourself up for a smoother ride to greater success. Join Marc Stoiber, founder of Brands Investors Love and former creative director for brands like Mr. Clean, McDonald’s and Budweiser as he lays out the roadmap.

Growth isn’t just about increasing revenue or expanding market share. It’s about survival in a competitive marketplace. Companies that stagnate risk falling behind, while those that embrace growth opportunities position themselves for long-term success.

Join seasoned buyers as they share advice on navigating growth in competitive markets. Discover how embracing growth opportunities can enhance shareholder value and lead to long-term success.

Ampere Chan, Managing Partner, Acorn Partners Inc. (Formerly President at Tiny)

Manny Padda, Founder, New Avenue Capital Group of Companies

Reece Tomlinson, Founder & CEO, RWT Growth

Dive into the future and uncover the latest playbook in M&A. This session will address the crucial questions of timing, valuation and AI integration to help you stay ahead of the curve. You will also learn whether advanced AI integration is a must-have for buyers and gain insights into the latest M&A activity in the AI sector. Join us to find out if you are ahead of the game or lagging behind!

Edoardo De Martin, CEO & Co-Founder, Industrio AI Inc.

Austin Johnsen, Sr. Director, Corporate Development, Zapier

Are you at a crossroads in your business growth journey? Perhaps you are struggling to choose between raising additional capital or pursuing M&A opportunities. What if you didn’t have to pick just one option? What if you could unlock new avenues for expansion and liquidity by pursuing both options simultaneously? That’s where a majority recapitalization comes in, led by a PE or growth equity fund. PE and growth equity funds have significant dry powder, and have a tried and true playbook for scaling companies. This session will explore the advantages of this funding and two-step exit strategy. With a recapitalization, you can breathe new life and capital into your company and propel your business trajectory toward unparalleled growth, de-risk by taking chips off the table for founders, employees and early investors, and set the stage for a future liquidity event via an acquisition or IPO.

Jeff Klemens, Partner, Sageview Capital

Maria Pacella, Managing Partner, Pender Ventures

Josh Wang, Vice President, JMI Equity

In this session we’ll sit down with the former CFO of Later as we uncover insights from working with advisors, the executive team and the board. Attendees will learn the crucial role of the CFO in driving strategic alignment and growth. You’ll walk away with practical guidance on M&A readiness, enhancing business appeal, and navigating negotiations and post-deal transitions.

*PROGRAM AND SCHEDULE SUBJECT TO CHANGE.